Arched Shape Clutch Purse Frame Prices Trend in 2025

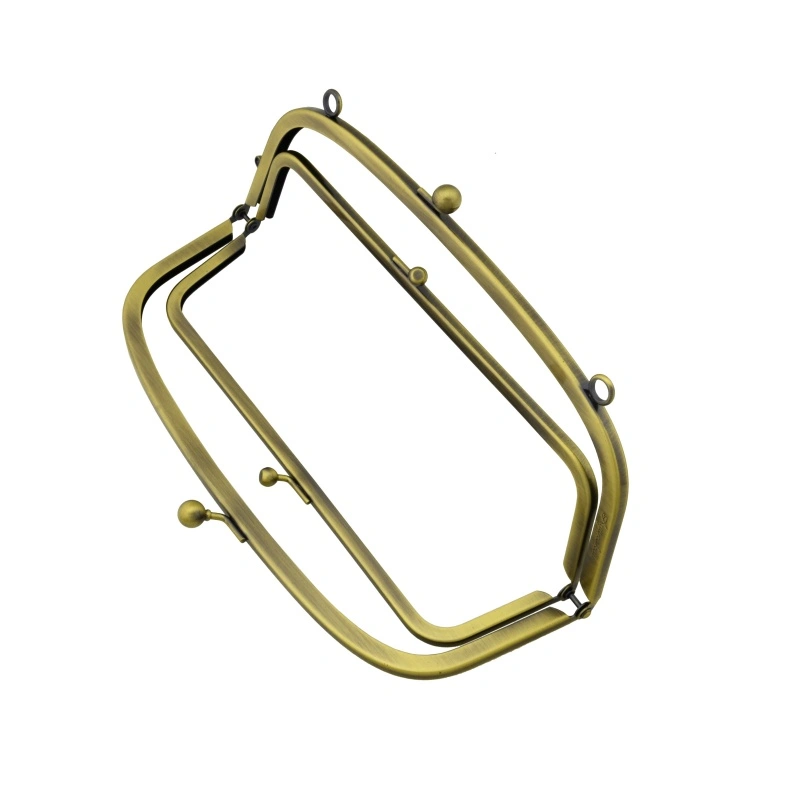

Handbag designers and accessory buyers often turn to arched shape clutch purse frames when crafting elegant evening bags or structured purses. These metal components, with their distinctive curved tops, provide both aesthetic appeal and functional closure. As 2025 approaches, understanding price movements becomes essential for procurement decisions. Factors such as supply chain pressures shape these trends, affecting buyers of metal purse frames, evening bag frames, and related hardware like plates, pullers, handles, buckles, and locks. Data from industry reports indicates potential rises, yet opportunities for cost-effective sourcing persist through reliable suppliers.

Global demand for arched clutch purse frames continues to grow, driven by fashion's emphasis on vintage-inspired designs. Manufacturers in regions like China, a primary origin for these items, report steady orders. Yet, price stability hinges on several variables. Buyers who anticipate shifts can secure better deals. Consider how raw materials form the foundation of these changes.

Raw Material Cost Increases

Iron, the primary material in many arched shape clutch purse frames, faces upward price pressure in 2025. Market analyses from the London Metal Exchange project iron ore costs to climb by 8-12% due to mining constraints in major exporters like Australia and Brazil. Supply disruptions, including weather events and regulatory hurdles, limit output. When producers pass these expenses along, frames that once sold for standard rates edge higher.

Finishing processes add another layer. Brush antique brass, a popular choice for its subtle sheen on 21cm arched shape parent-child purse frames, relies on brass alloys. Copper prices, a key component, have surged 15% year-over-year, per World Bureau of Metal Statistics. Electroplating, essential for durability and that coveted antique look, consumes zinc and nickel—metals whose costs fluctuate with energy demands in smelting. A frame measuring 21cm by 8cm, crafted from iron with such finishes, could see material-driven hikes of 10-15% if current trajectories hold.

Environmental regulations intensify this trend. Stricter emissions standards in China, where many purse frame hardware originates, raise compliance costs for foundries. Factories adapt by investing in cleaner tech, which filters into product pricing. Buyers of purse making frames notice these shifts first, as smaller orders absorb less of the burden than bulk runs. Does opting for basic iron over plated versions help? Sometimes, though customization requests for colors and sizes amplify expenses when rare alloys enter the mix.

Manufacturing Adjustments

Factories producing arched shape clutch purse frames refine operations amid labor and tech shifts, influencing 2025 costs. In Shenzhen, hubs like Carol Metal Products Co., Ltd. leverage in-house electroplating to streamline from design to packing. Such vertical integration cuts intermediaries, yet broader adjustments push prices. Skilled welders, vital for precise arched shapes, command higher wages as China's aging workforce prompts training investments.

Automation enters the picture unevenly. CNC machines shape metal efficiently for sizes like 21cm purse frames, reducing waste. However, upfront costs for these systems, combined with maintenance, distribute over production volumes. Smaller runs for custom parent-child wallet frames—those paired sets for matching purses—prove costlier per unit. Brass brushing, applied post-forming, demands calibrated equipment to avoid defects, and recalibrations during material switches add overhead.

OEM/ODM demands evolve too. Buyers seek novel styles in multi-colors, prompting R&D spends. Carol, with years in handbag frames and luggage hardware, handles such requests seamlessly, offering iron bases customizable to spec. Yet industry-wide, prototyping for unique arched clutch designs extends lead times, tying up capacity. Certifications for safety and eco-materials, increasingly mandatory for evening bag frames, require testing that fees scale with complexity.

Energy costs weave through every stage. Power rates in manufacturing zones rise with grid upgrades, directly hitting forging and plating. A frame's journey—from iron melting to final polish—consumes kilowatts, and surges of 20% in electricity tariffs, as reported by China's National Development and Reform Commission, embed in quotes. Savvy procurers favor suppliers with efficient lines, mitigating these hikes. Adjustments like batch optimizations help, but expect 5-10% manufacturing-led increases across metal clasp purse frames.

Market Dynamics

Consumer preferences steer arched shape clutch purse frame prices through demand waves. Luxury handbag trends favor structured clutches, boosting orders for elegant metal frames in 2025. Fashion weeks in Paris and Milan spotlight vintage arches, per Vogue Business, spurring production. Yet oversupply in fast-fashion segments tempers rises, as low-end frames flood markets via platforms like Alibaba.

Competition sharpens regionally. Chinese origins dominate, with firms like Carol exporting novel styles praised in domestic and foreign markets. Their one-line service—from plating to packing—appeals to buyers of buckles, locks, and handles. Global rivals in India and Vietnam scale up, pressuring prices downward for standard 21cm models. Tariffs, however, complicate imports; U.S. duties on metal hardware linger, nudging buyers toward origins like China with favorable agreements.

E-commerce accelerates dynamics. Online marketplaces enable direct sourcing of purse frame supply, where volume buyers snag discounts. Seasonal peaks, around holidays or bridal seasons, strain capacity, inflating spot prices. Data from Statista predicts handbag hardware market growth at 4.5% CAGR, yet inflation caps spending. Custom requests for brush antique brass on parent-child frames hold premium, as niche appeal sustains margins.

Sustainability sways choices. Eco-conscious brands prioritize durable, recyclable iron frames, rewarding certified suppliers. Carol's environmentally friendly materials and high-quality after-sales align here, backed by OEM processing and partner collaborations. Market watchers at Deloitte note that premium dynamics favor versatile hardware for leathers and luggage, potentially lifting prices 7% for specialized arched shapes amid broader stabilization.

Ready to navigate these trends? Contact tony@carolxiao.com at Shenzhen Carol Metal Products Co., Ltd., your arched shape clutch purse frame supplier. Specializing in the 21cm arched shape parent-child purse metal clutch purse frame (21cm*8cm, Brush Antique Brass finish, iron material from China), we offer customizable sizes, colors, and materials for parent-child wallet frames, purse making, and hardware like closures. With our electroplating factory enabling design-to-packing service, OEM/ODM, and eco-durable products popular worldwide, secure competitive 2025 pricing today—reply for samples and quotes.

References

- London Metal Exchange. (2024). Iron Ore Price Forecast 2025.

- World Bureau of Metal Statistics. (2024). Copper and Brass Market Report.

- McKinsey & Company. (2024). Global Supply Chain Trends in Fashion Hardware.

- Statista. (2024). Handbag Accessories Market Analysis 2020-2028.

- China National Development and Reform Commission. (2024). Energy Pricing Updates.

_1753256285958.png)

_1754990596544.webp)